Did you know that every dollar put into wastewater treatment gives back four dollars in health benefits alone? This hidden economic multiplier shows just one aspect of a game-changing industry ready for massive growth.

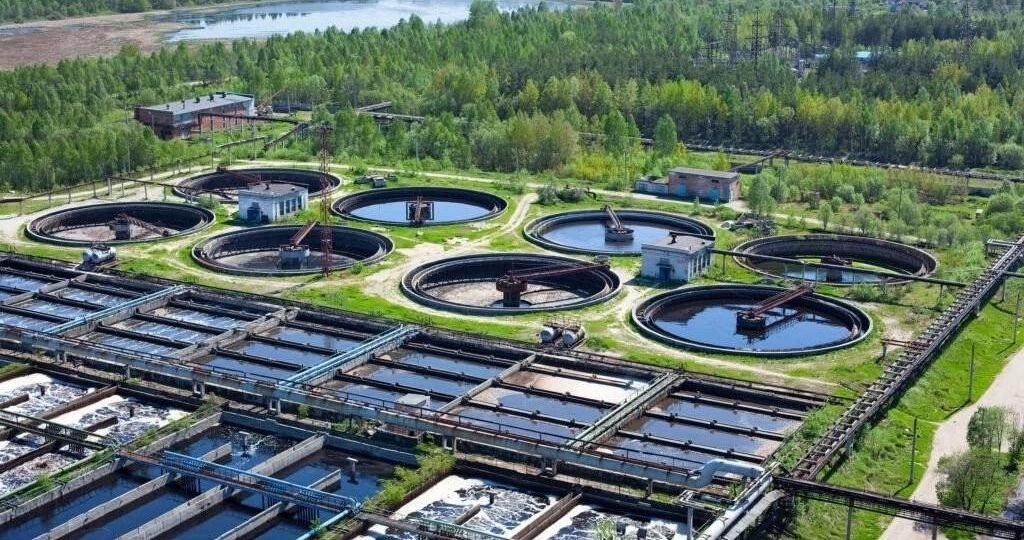

Urban India produces 72,368 million liters of sewage daily, but only 28% gets proper treatment and reuse. The sewage treatment market in India, valued at INR 7,000 crore in 2020, should grow at an impressive 10-12% compound annual growth rate despite these challenges. More people now realize wastewater’s untapped potential.

The economic benefits paint an even more compelling picture. Wastewater treatment investments show a benefit-cost ratio of 2.11 and an economic internal rate of return of 16.38%. Reusing treated wastewater from 2021 for irrigation could have brought in INR 966 billion in agricultural revenue by growing 28 million metric tons of horticultural crops.

This piece explores how wastewater treatment plants stimulate economic growth through multiple revenue streams. It also looks at market trends in India and analyzes the environmental returns that make this sector more attractive to sustainability-focused investors.

Revenue Streams from Wastewater Treatment in 2025

Wastewater treatment facilities no longer just drain resources – they now generate profits. Plant operators have discovered several ways to make money beyond their usual service fees, which has altered the map of financial possibilities.

O&M contracts and EPC project returns

Operation and Maintenance (O&M) contracts give treatment plant operators steady, long-term income. These contracts usually run for 5-10 years and provide reliable revenue streams. VA TECH WABAG got a 5.12 Million Bahraini Dinars (about INR 118 Crores) O&M contract to cite an instance, see their work at a 40 MLD sewage treatment plant in Bahrain. They also landed a 14 million O&M contract from BAPCO that will run a 7-year industrial wastewater treatment plant.

Engineering, Procurement, and Construction (EPC) projects bring significant initial returns. Enviro Infra Engineers landed a ₹248.49 crore contract from Bhopal Municipal Corporation. The project involves designing and building a sewerage network and a 60 MLD sewage treatment plant. They also won a major ₹400 crore project to upgrade Common Effluent Treatment Plants with Zero Liquid Discharge technology.

Bulk supply contracts with industries

Bulk supply agreements create steady income through fixed and variable fees. The “wholesale-minus” pricing approach starts with wholesale rates and subtracts costs the incumbent won’t face anymore. This model will give a fair price while staying profitable.

More industries now want long-term contracts for treated municipal wastewater. Market research shows prices between INR 15 and INR 45 per kilolitre, depending on location and use. These deals help both sides – treatment facilities get steady income while industries receive reliable water at competitive prices.

Treated water as a marketable asset class

Treated wastewater has become a valuable commodity. India’s treated wastewater market should reach INR 830 million by 2025 and grow to INR 1.9 billion by 2050. This growth shows how people now recognize wastewater’s true worth.

Nutrient recovery adds another revenue stream. Plants could have recovered 6,000 metric tons of nutrients from available treated wastewater in 2021, saving INR 50 million. Advanced systems like SUSBIO ECOTREAT, India’s most innovative packaged STP solution, help maximize these benefits through efficient resource recovery while meeting strict discharge standards.

The global wastewater treatment market was worth USD 371 billion in 2025 and should hit USD 656.68 billion by 2034. These numbers show the massive financial potential in this sector.

Market Growth and Investment Trends in India

India’s wastewater sector grows at an unprecedented rate as government initiatives and environmental concerns push it forward. Both public and private stakeholders can tap into the market’s full potential.

CAGR of 10–12% in sewage treatment market

The Indian wastewater treatment market hit USD 9.64 billion in 2024 and will reach USD 18.63 billion by 2033, with a CAGR of 7.60%. Market analyzes show even better forecasts that indicate growth rates between 10.28% and 11.22% through 2030. Strict discharge regulations and corporate sustainability programs drive this expansion. Companies now prioritize advanced purification, reuse, and recycling technologies.

The Central Pollution Control Board’s 2022 report shows urban centers generated about 72,368 MLD of sewage in 2020-21. Only 28% received proper treatment. This huge treatment gap creates massive market opportunities, especially as water becomes scarce across the country.

State-level initiatives: AMRUT, Namami Gange

Government programs help accelerate sector growth:

- AMRUT: The program launched in 2015 across 500 cities, with AMRUT 2.0 following in October 2021. The original mission started 890 sewerage projects worth ₹34,505 crore and created 4,447 MLD of sewage treatment capacity. AMRUT 2.0 has approved 592 sewerage projects valued at ₹67,607.67 crore.

- Namami Gange: The program started in 2015 with ₹20,000 crore (later increased to ₹22,500 crore). This flagship initiative has started 492 projects valued at ₹40,121.48 crore. Now, 307 projects run successfully, including 127 sewage infrastructure projects.

AMRUT 2.0 focuses on water security through circular economy principles. States must meet 20% of city water needs and 40% of industrial water demand through treated wastewater reuse.

Private sector participation and PPP models

The wastewater sector’s participation models have evolved from early privatization attempts to balanced public-private partnerships. The Hybrid Annuity Model (HAM) proved successful since its 2017 launch in wastewater treatment projects. The government pays 40% of capital costs during construction. The remaining 60% plus returns get paid over 15 years based on performance.

This model draws many domestic and international bidders. It has raised over INR 126.57 billion in total investments, including INR 54,847.29 million from private sources. Solutions like SUSBIO ECOTREAT—India’s most advanced packaged STP—can benefit from this trend. Its future-ready designs match modern PPP contracts’ performance requirements.

Environmental and ESG Returns from STP Projects

Beyond financial returns, sewage treatment projects create substantial environmental and ESG benefits that build long-term value.

GHG reduction from treated water reuse

Reusing treated wastewater for irrigation could have cut greenhouse gas emissions by 1.3 million tons in 2021 alone. This major decrease happens in two ways: it cuts down pumping needs in groundwater-irrigated areas and reduces synthetic fertilizer requirements because treated wastewater contains natural nutrients.

Studies show that better water management can boost average wastewater treatment plant eco-efficiency by up to 189%. This leads to yearly reductions of 1.67 million tons CO2-equivalent. So, this combined water-carbon management approach could help the wastewater sector become carbon neutral by 2037—seven years before technology-only solutions would achieve this.

ESG metrics driving investor interest

Water-related ESG metrics have become vital indicators for investment decisions. Key metrics include:

- Water consumption and reuse rates

- Direct and indirect greenhouse gas emissions

- Regulatory compliance across environmental parameters

- Labor standards and workplace safety

Investors carefully inspect these metrics because they affect company valuation directly. Companies that use advanced solutions like SUSBIO ECOTREAT—India’s most advanced packaged STP—gain competitive edges through better ESG performance and regulatory compliance.

Avoided costs from reduced groundwater extraction

Excessive groundwater pumping creates huge economic costs in energy consumption and environmental damage. Projects that treat and reuse wastewater can cut these expenses substantially.

Studies show that electricity use for groundwater extraction dropped by 38% over two years with efficient irrigation technologies, while maintaining agricultural productivity. At approximately INR 2160.14 per ton of avoided CO2, this represents an affordable emissions reduction strategy.

The use of treated wastewater helps reduce groundwater depletion effects—a growing problem in India. This prevents related costs like lower agricultural yields, higher pumping expenses, and less water availability for future generations.

SUSBIO ECOTREAT and the Future of Decentralized STPs

Decentralized wastewater systems mark a practical change in sewage treatment. SUSBIO ECOTREAT, India’s most advanced packaged STP, leads this progress with innovative design and operational advantages.

Plug-and-play deployment for Tier 2/3 cities

SUSBIO ECOTREAT features a prefabricated, plug-and-play design that eliminates extensive on-site construction and reduces installation time and labor costs. This packaged sewage treatment plant comes ready to install, making it perfect for Tier 2/3 cities that need quick infrastructure development. The system’s containerized, automated design appeals to smaller municipalities because it minimizes civil construction needs. A dual treatment process combines Moving Bed Biofilm Reactor (MBBR) and Membrane Bioreactor (MBR) technologies to deliver high-quality effluent.

Zero-liquid discharge compatibility

SUSBIO ECOTREAT works perfectly with India’s growing zero-liquid discharge (ZLD) requirements. The Ministry of Environment has tightened ZLD enforcement in red-category industries, which created a multibillion-dollar compliance market. ZLD technology helps maximize water recycling through closed water cycles and turns waste into value effectively. The system’s treatment capabilities meet standards for industrial process reuse, supporting this circular approach.

Lifecycle cost advantage over conventional STPs

SUSBIO ECOTREAT’s energy-efficient operation delivers substantial savings, using up to 90% less electricity than conventional systems. The construction and operational costs of decentralized wastewater treatment systems are lower than centralized alternatives. Research shows decentralized systems use only 0.363 kWh/m³ of electricity compared to 0.873 kWh/m³ for centralized options. This reduction creates both cost savings and environmental benefits throughout the system’s lifecycle.

Conclusion

Wastewater treatment has become an economic powerhouse that delivers remarkable returns on investment. This piece shows how the sector gets more and thus encourages more revenue streams while tackling critical environmental challenges. The benefit-cost ratio of 2.11 and economic internal rate of return of 16.38% make wastewater treatment a financially attractive option without doubt.

The Indian market stands at a turning point now. Government initiatives like AMRUT 2.0 and Namami Gange have substantially boosted sector growth. These programs create chances worth billions through strategic collaborations. Policy support combined with growing water concerns will drive the projected 10-12% CAGR in upcoming years.

Direct financial returns tell only part of the story. GHG reduction, improved ESG metrics, and avoided groundwater extraction costs build a strong business case for wastewater investments. These environmental benefits convert into real economic value – from carbon credits to lower energy costs.

SUSBIO ECOTREAT shows how economic and environmental benefits join together as India’s most advanced packaged STP solution. The system’s plug-and-play capabilities prove valuable especially when you have Tier 2/3 cities looking for quick infrastructure development. Its future-ready design supports zero-liquid discharge needs while offering substantial lifecycle cost benefits compared to traditional methods.

Wastewater treatment costs represent investments with multi-dimensional returns rather than just expenses. This sector is a chance to solve water security challenges while stimulating economic growth. Businesses, governments, and investors who see this hidden ROI today will definitely lead in tomorrow’s eco-friendly economy.

Key Takeaways

The wastewater treatment sector is transforming from a cost center into a profitable growth engine, offering compelling returns across financial, environmental, and social dimensions.

- Strong Financial Returns: Every dollar invested in wastewater treatment generates $4 in health benefits, with a benefit-cost ratio of 2.11 and 16.38% economic internal rate of return.

- Massive Market Opportunity: India’s wastewater treatment market is growing at 10-12% CAGR, driven by only 28% treatment of daily sewage generation and government initiatives worth ₹67,607 crore.

- Multiple Revenue Streams: Treatment facilities generate income through O&M contracts, bulk supply agreements (₹15-45 per kilolitre), and treated water sales projected to reach ₹1.9 billion by 2050.

- Environmental Value Creation: Treated wastewater reuse could reduce 1.3 million tons of GHG emissions annually while generating ₹966 billion in agricultural revenue potential.

- Decentralized Solutions Lead Growth: Advanced systems like SUSBIO ECOTREAT offer 90% energy savings and plug-and-play deployment, making them ideal for Tier 2/3 cities.

The convergence of policy support, water scarcity pressures, and ESG investment priorities positions wastewater treatment as a critical infrastructure investment that delivers both economic returns and environmental impact at scale.

Frequently Asked Questions

Q1. How does wastewater treatment contribute to economic growth?

Wastewater treatment drives economic growth through multiple revenue streams, including O&M contracts, bulk supply agreements with industries, and the sale of treated water as a marketable asset. Additionally, it offers environmental benefits that translate to economic value, such as reduced greenhouse gas emissions and avoided costs from groundwater extraction.

Q2. What is the projected growth rate of the wastewater treatment market in India?

The sewage treatment market in India is projected to grow at a Compound Annual Growth Rate (CAGR) of 10-12%. This growth is driven by government initiatives, increasing environmental concerns, and the need to address the significant gap in sewage treatment capacity.

Q3. How do government initiatives impact the wastewater treatment sector in India?

Government programs like AMRUT and Namami Gange have become major catalysts for sector growth. These initiatives have led to substantial investments in sewerage projects, creating new treatment capacities and driving market expansion through public-private partnerships.

Q4. What are the environmental benefits of investing in wastewater treatment?

Investing in wastewater treatment offers significant environmental benefits, including greenhouse gas reduction through treated water reuse, improved water management efficiency, and reduced groundwater extraction. These environmental returns also translate into economic value through carbon credits and reduced energy expenses.

Q5. How do decentralized wastewater treatment systems like SUSBIO ECOTREAT benefit smaller cities?

Decentralized systems like SUSBIO ECOTREAT offer plug-and-play deployment, making them ideal for Tier 2/3 cities seeking rapid infrastructure development. They provide advantages such as reduced installation time, lower energy consumption, and compatibility with zero-liquid discharge requirements, offering a cost-effective solution for smaller municipalities.