Zero liquid discharge (ZLD) serves as a smart wastewater management system that will give a clean environment with zero industrial wastewater release. The system treats wastewater and concentrates contaminants. This allows industries to reuse up to 90% of treated water in non-potable applications like boilers or cooling towers. ZLD plays a crucial role in India because the country has just 4% of global water resources while supporting 16% of the world’s population.

This piece looks at how strict industrial wastewater rules have made zero liquid discharge systems more common. Mylan’s ZLD facilities showcase success with consistent operations since 2009. You’ll learn about setup costs, running expenses, and possible investment returns. These systems help companies recycle water, manage solid waste better, reuse byproducts, and protect the environment. Forward-thinking Indian manufacturers should think over these benefits carefully.

Understanding Zero Liquid Discharge (ZLD) in the Indian Context

The concept of zero liquid discharge has caught on by a lot in India’s manufacturing sector over the last several years. Companies have adopted it to address growing environmental concerns and resource limitations. Let’s take a closer look at what ZLD means in India’s industrial world.

What is Zero Liquid Discharge and Why It Matters

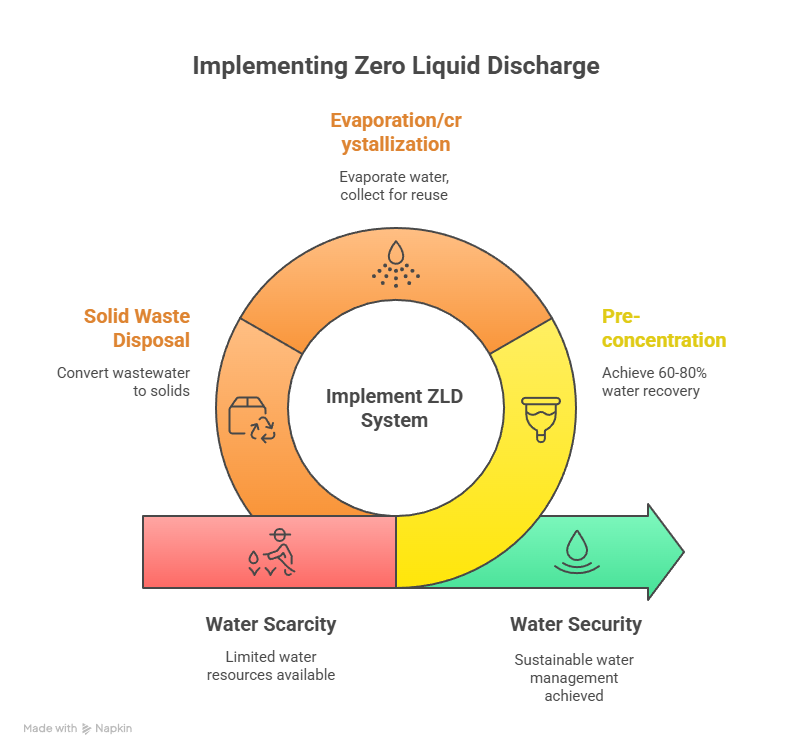

Zero Liquid Discharge (ZLD) is a strategic wastewater management system that eliminates industrial wastewater discharge into the environment completely. ZLD works as a closed-loop cycle that treats wastewater through intensive recycling, recovery, and reuse processes for industrial applications.

ZLD can get pricey to set up, but it brings strong economic benefits by helping recover valuable salts and chemical compounds. Three main factors make industries adopt ZLD:

- Water scarcity – a critical issue in water-stressed regions

- Economic considerations – you save money long-term through resource recovery

- Environmental compliance – you meet strict regulatory requirements

ZLD systems make good business sense and show corporate responsibility and environmental care. Smart companies don’t just see it as an environmental solution. They see it as a strategic advantage for compliance, sustainability goals, and long-term water security.

Zero Liquid Discharge Meaning in Industrial Wastewater

From a technical point of view, ZLD is an engineering approach where we recover all water and reduce contaminants to solid waste. The process gets tougher as wastewater becomes more concentrated, with salinity, scaling compounds, and organics building up during treatment.

A typical ZLD system includes these treatment stages:

- Pre-concentration: We use membrane brine concentrators or electrodialysis to achieve 60-80% water recovery

- Evaporation/crystallization: Thermal processes evaporate remaining water, which we collect for reuse while impurities crystallize into filterable solids

Different facilities might define their “boundary conditions” differently. True ZLD usually uses the facility’s property line as the border where we treat, recycle, and convert wastewater to solids for disposal. Some facilities might send liquid waste off-site for treatment or disposal and still call it ZLD – but this can drive up costs.

Water Scarcity and Industrial Demand in India

India’s severe water challenges make ZLD implementation crucial. The country has battled acute water shortages in many regions. Rapid urbanization, industrialization, and climate change keep making this situation worse.

Many industries across India rely heavily on water resources:

- Textile and dyeing units produce high-color, high-salt effluents

- Thermal power plants need lots of cooling water

- Pharmaceutical facilities create high-organic-content wastewater

- Chemical manufacturing operations generate potentially hazardous effluents

Water stress becomes unavoidable as India’s population grows and water consumption rises. This reality, plus strict regulations, has pushed industries to try innovative solutions like zero liquid discharge systems.

Sustainable water management has become crucial because traditional wastewater treatment and discharge methods no longer work. Several industrial sectors in India now just need to implement ZLD systems by law. These include textiles, tannery, bulk drugs, and distilleries – especially under guidelines from the Central Pollution Control Board (CPCB) and State Pollution Control Boards (SPCBs).

Core Components of a Zero Liquid Discharge System

A complete zero liquid discharge (ZLD) system needs multiple specialized treatment stages that work together to eliminate liquid waste. Each component has a vital role to remove contaminants, concentrate dissolved solids, and recover water.

Pretreatment and Physicochemical Processes

The original industrial wastewater treatment starts with significant pretreatment to remove suspended solids, oils, and scaling compounds that could harm downstream equipment. The process begins when water moves through screening or bar screens that catch large particles and floating debris. The water then moves through reactor tanks where heavy metal ions turn into insoluble hydroxide and sulfide salts when mixed with caustic soda, lime, sodium sulfide, or proprietary organosulfides.

The next step adds specific polymers, ferric chloride, or alum that create larger flocs and settle faster in a clarifier. The quickest way to operate involves chemical softening with lime (CaO) or sodium carbonate (Na₂CO₃) before membrane processes. This removes hardness ions like calcium and magnesium that cause scaling. A filter press or centrifuge then dehydrates the settled precipitates.

Membrane Filtration and Reverse Osmosis

The pretreated wastewater moves to membrane filtration systems that remove smaller and smaller contaminants. Ultrafiltration (UF) serves as the first membrane barrier and removes all remaining suspended solids, colloids, bacteria, and macromolecular organics larger than 10,000 Da. This protection stops fouling and scaling in later processes.

Reverse osmosis (RO) stands as the main water recovery technology in most ZLD systems, with salt rejection rates that exceed 90%. RO concentrates wastewater until osmotic pressures reach acceptable limits, usually around 70,000 mg/L TDS. Higher recovery rates need additional technologies like electrodialysis (ED/EDR), which reaches brine salinity of 100,000–200,000 mg/L, or forward osmosis (FO), which concentrates industrial brine to 220,000 mg/L.

Evaporation and Crystallization Units

Thermal processes become essential beyond membrane concentration limits. Brine concentrators using Mechanical Vapor Compression (MVC) or Multiple-Effect Evaporation (MED) achieve water recoveries of 90–98% and produce high-quality distillate with TDS below 10 mg/L. These units work through falling film evaporation, often with calcium sulfate seeds to minimize scale formation.

Crystallization eliminates the remaining water and creates dry solid waste as the final step. Forced circulation crystallizers handle highly concentrated and scaling-prone wastewater effectively. The crystallizer boils until all impurities crystallize and filter out as solids. The process can use various technologies – forced circulation crystallization, vacuum crystallization, cooling crystallization, and anti-solvent crystallization. Each gets selected based on specific brine characteristics.

Zero Liquid Discharge Plant Flow Diagram Overview

The complete ZLD system connects all components in sequence. Raw wastewater starts at pretreatment (screening, chemical treatment, clarification), moves to membrane filtration (UF, RO or alternatives), then thermal concentration (evaporation), and ends with crystallization. Water quality improves while waste volume decreases throughout this process.

Different industries need customized configurations based on their wastewater characteristics. To cite an instance, textile industries with high TDS effluents might need improved softening, while pharmaceutical waste could require additional organic removal steps. Whatever the industry, effective ZLD systems recover about 95% of wastewater and turn contaminants into manageable solid waste.

Cost Breakdown: CAPEX, OPEX, and ROI for ZLD Plants

Indian manufacturers just need a big financial commitment to implement zero liquid discharge systems. The cost structure looks quite different from regular treatment methods.

Original Capital Investment for ZLD Systems

The upfront cost of ZLD facilities changes based on size and technology. Medium-sized industrial systems cost between ₹337.52-20 million. This is a big deal as it means that it costs more than regular treatment systems at ₹84.38-5 million. Smaller systems with 100 KLD capacity need ₹1-1.5 crores. On top of that, it takes about 1.5 acres of land per MLD.

The capital costs cover engineering, procurement, and construction (EPC) services that match each industry’s needs. The investment gets bigger because these systems need complex integration of membranes, filtration units, evaporators, and crystallizers from different manufacturers.

Operational Costs: Energy, Labor, and Maintenance

The daily running costs affect how viable these systems are in the long run:

- Energy consumption: Thermal plants use 80-100 kWh/m³. Regular treatments are nowhere near that, using only 0.5-1.5 kWh per cubic meter. The high energy use remains the biggest problem.

- Chemical costs: The system constantly needs treatment chemicals, anti-scaling agents, and pH adjusters.

- Labor expenses: The core team must be highly skilled, which drives up staffing costs.

- Maintenance requirements: The system works non-stop only with regular checks, cleaning, calibration, and part replacements.

Running costs in places like Tirupur usually hit ₹200-250 per kiloliter. Regular systems with primary and secondary treatment cost just ₹15-30 per kiloliter.

ROI Timeline for Zero Liquid Discharge Plant in India

The vital question is when you’ll get your money back. Most ZLD projects pay for themselves in 3-5 years. We saved water and recovered byproducts. Chemical manufacturing plants with 100 KLD capacity can see returns in just 2.8 years. Here’s what affects the ROI:

- Savings on water purchases (prices vary: ₹17/m³ in Ichalkaranji to ₹75/m³ in Tirupur)

- No more wastewater disposal fees

- Money from recovered salts and metals

- Benefits from tax breaks and following regulations

Cost Comparison with Conventional Effluent Treatment

ZLD systems cost 4-5 times more than regular treatment options at first. The price jumps because you need special equipment to concentrate and crystallize waste. The good news? These systems recover 90-95% of water. This helps balance costs in areas where fresh water is scarce and expensive.

Manufacturers should think about whether the long-term savings make up for the big investment. They need to look at both the money they’ll make back and other benefits like following regulations and being more sustainable.

Industry-Specific ZLD Implementation Strategies

Each industrial sector faces its own wastewater challenges that need specific zero liquid discharge solutions. Industries must deal with unique contaminants, follow regulations, and balance costs when they implement ZLD systems.

Textile Industry: High TDS Wastewater Recovery

India’s textile industry clusters in manufacturing hubs like Tirupur, Ludhiana, Surat, and Panipat. The wastewater from these facilities contains high TDS (5,000-15,000+ mg/L), high pH (9-11), and substantial color content. Textile ZLD implementation starts by separating high-color, high-TDS streams to treat them specifically.

IIT Madras has created an innovative electrochemical ozone oxidation process (ECOOP) that removes 96% of color and 60% of COD from textile dyebath effluent. This system cuts RO system load by 75% and doesn’t create the carcinogenic chlorinated compounds found in standard systems. Common effluent treatment plants with ZLD capabilities have worked well economically for textile clusters, with Tirupur alone running more than 18 such facilities.

Pharmaceutical Sector: API Cluster Compliance

The Central Pollution Control Board requires pharmaceutical manufacturers to implement ZLD, whatever their facility size. These plants struggle with wastewater that contains active pharmaceutical ingredients (APIs), non-biodegradable organics, and solvents.

Pharmaceutical ZLD works best by separating streams – directing high-COD/toxic loads to advanced oxidation, moderate-COD streams to biological treatment, and high-TDS/low-COD streams to evaporation. The sector uses membrane bioreactors (MBR) or sequential batch reactors (SBR) with reverse osmosis. This combination recycles up to 90% of treated water for non-potable uses.

Power Plants: Boiler Feedwater Reuse

Power plants use 60-80 million liters of water daily for 1000-1300 MW operations. Cooling towers consume 80% while boiler feedwater needs 5%. The sector’s ZLD systems focus on recovering cooling tower blowdown with its high salt content.

An integrated water treatment plant-effluent treatment plant (WTP-ETP) handles power plant wastewater (about 125 m³/h) for boiler feedwater. This setup cuts fresh water needs by 40,000 m³ yearly. It also reduces evaporation system size by almost 50% through better recovery rates.

Chemical and Petrochemical Plants: Salt Recovery

Chemical manufacturing’s wastewater contains multiple dissolved salts, which creates complex crystallization issues. Unlike simple commodity manufacturing that crystallizes single salts, industrial ZLD systems must handle mixed salt solutions that cause extreme foaming and quick scaling.

Forced circulation crystallizers manage the final concentration stages in these plants effectively. Modern systems combine mechanical vapor recompression (MVR) cycles with specialized filtering to reduce costs. Salt recovery turns waste streams into valuable products, which creates sellable materials and minimizes disposal needs.

Government Regulations and Incentives for ZLD Adoption

India’s industrial sector follows regulatory frameworks that promote zero liquid discharge adoption. Government mandates and financial support make ZLD implementation a requirement that companies can afford.

CPCB and State Pollution Control Board Guidelines

The Central Pollution Control Board (CPCB) enforces strict ZLD compliance rules to prevent water pollution and encourage wastewater recycling in major polluting sectors. The CPCB develops technical guidelines for industrial ZLD implementation under the Water Act of 1974 and Environment Protection Act of 1986. These guidelines set effluent standards, suggest suitable technologies, and require consistent monitoring of effluent quality.

Mandates for CETP and In-House ZLD Systems

India introduced specific ZLD guidelines for textile, tanneries, distilleries, and pulp & paper industries in 2015. The national mandate required textile industries with effluent discharge above 25 KLD to implement ZLD systems. The MoEFCC’s 2016 notification stated that MSME textile units must meet discharge standards. Large standalone units in environmentally sensitive areas might need to achieve ZLD.

Financial Incentives and Subsidies for ZLD Projects

The government runs the Integrated Processing Development Scheme (IPDS) to support textile processors who want to establish and upgrade Common Effluent Treatment Plants. This program gives grants up to 50% of project costs, with a cap of ₹75 crore for ZLD systems. States like Odisha provide extra incentives. MSME manufacturing units that adopt ZLD can get environmental protection infrastructure subsidies worth ₹20 lakhs or 20% of capital costs.

Conclusion

Zero Liquid Discharge technology is a vital solution for Indian manufacturers who face tougher environmental rules and a growing lack of water. The original investments are big, but the benefits over time clearly make up for these costs through water recovery, byproduct use, and following regulations.

Success stories from textile, pharmaceutical, power, and chemical sectors show proven ways to make it work. These examples highlight that custom approaches based on specific wastewater types give the best results. On top of that, government support through IPDS programs cuts down costs by a lot. This makes ZLD available to manufacturers of all sizes.

ZLD makes even more sense when you look at India’s unique water problems. Water recovery rates of 90-95% lead to big savings in areas where fresh water costs a premium. Indian manufacturers should see ZLD as more than just following rules – it’s a smart investment that pays off.

The future looks promising as new tech keeps bringing down both setup and running costs. Today’s state-of-the-art evaporation systems and advanced membrane technologies point to more affordable ZLD options. Manufacturers who set up these systems now will be ready to handle future water challenges better.

The shift to zero liquid discharge shows how industrial water management needs to change. Indian manufacturers who adopt this approach protect important water resources. They also build stronger, environmentally responsible, and profitable operations for years to come.

Key Takeaways

Zero Liquid Discharge (ZLD) technology is transforming Indian manufacturing by eliminating wastewater discharge while recovering up to 95% of water for reuse, making it essential for water-scarce regions.

- ZLD systems require ₹1-1.5 crores initial investment for 100 KLD capacity but achieve ROI within 3-5 years through water savings and byproduct recovery

- Government mandates ZLD for textile, pharmaceutical, tannery, and distillery sectors, with IPDS grants covering up to 50% of project costs (₹75 crore maximum)

- Energy consumption remains the biggest operational challenge at 80-100 kWh/m³ compared to 0.5-1.5 kWh/m³ for conventional treatment systems

- Industry-specific approaches are crucial: textile clusters use common effluent plants, pharmaceuticals require stream segregation, and chemical plants focus on salt recovery

- Despite 4-5x higher upfront costs than conventional treatment, ZLD delivers long-term value through regulatory compliance, water security, and sustainable operations

The Indian ZLD market’s projected growth to US$ 211 million by 2026 reflects manufacturers’ recognition that this technology represents not just environmental compliance, but a strategic competitive advantage in an increasingly water-stressed economy.

Frequently Asked Questions

Q1. What is Zero Liquid Discharge (ZLD) and why is it important for Indian manufacturers?

Zero Liquid Discharge is a wastewater management system that eliminates the discharge of industrial wastewater into the environment. It’s crucial for Indian manufacturers due to water scarcity, environmental regulations, and the potential for cost savings through water recycling and resource recovery.

Q2. How much does it typically cost to implement a ZLD system in India?

The initial investment for a ZLD system in India can range from ₹1-1.5 crores for a 100 KLD capacity plant. While this is 4-5 times more expensive than conventional treatment systems, ZLD systems often achieve a return on investment within 3-5 years through water savings and byproduct recovery.

Q3. What are the main components of a Zero Liquid Discharge system?

A typical ZLD system consists of pretreatment processes, membrane filtration (such as ultrafiltration and reverse osmosis), evaporation units, and crystallization technology. These components work together to progressively remove contaminants, concentrate dissolved solids, and recover water.

Q4. Are there any government incentives for implementing ZLD in India?

Yes, the Indian government offers financial incentives for ZLD implementation. The Integrated Processing Development Scheme (IPDS) provides grants up to 50% of project costs, not exceeding ₹75 crore for ZLD systems. Some states also offer additional subsidies for environmental protection infrastructure.

Q5. How does ZLD implementation differ across various industries in India?

ZLD implementation strategies vary by industry. For example, textile industries focus on high TDS wastewater recovery, pharmaceutical sectors emphasize API cluster compliance, power plants prioritize boiler feedwater reuse, and chemical plants concentrate on salt recovery. Each industry requires a tailored approach based on its specific wastewater characteristics and regulatory requirements.